👋 About

I am Lionel Sopgoui. I am currently Postdoctoral researcher in Mathematical and Actuarial Finance, at ENSAE Paris and Institut Louis Bachelier. With Prof. Caroline Hillairet and Prof. Olivier Lopez, we use different mathematic tools such as Hawkes processes, contagion and epidemiological models,extreme value theory, etc. to model and quantify cyber risks for finance and cyber insurance. Previously, I was PhD student in Mathematical Finance, at Université Paris Cité, at Imperial College London and at Risk division at BPCE S.A. My thesis work revolves around Applications of Probability and Stochastic Control in Economic Modelling, Climate transition risk and Credit Risk. I was co-advised by Jean-François Chassagneux, Antoine (Jack) Jacquier and Smail Ibbou.

🚧 Ongoing works

Real Estate Pricing under transition risk: A Real Option Approach, with Jean-François Chassagneux.

A stochastic SIRS model for cyber contagion: application to firms growth and insurance portfolio, with Caroline Hillairet and Olivier Lopez.

📄 Publications

Preprints

Lionel Sopgoui. “Modeling the impact of Climate transition on real estate prices,” arXiv:2408.02339, 2024.

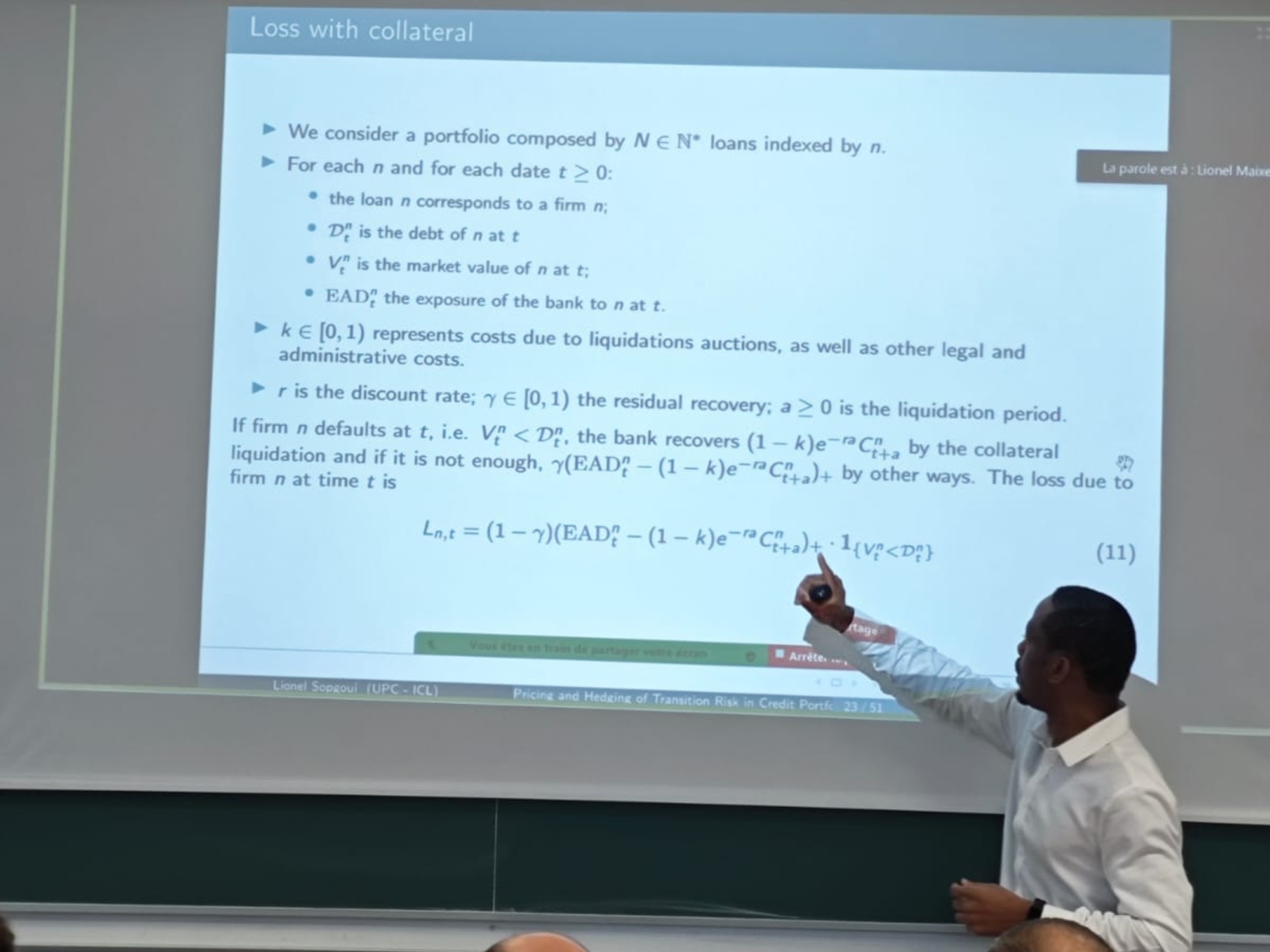

Lionel Sopgoui. “PhD thesis: Pricing and hedging of transition risk in Credit Portfolio,” Université Paris Cité, 2024.

2025

Lionel Sopgoui. “Impact of the carbon price on credit portfolio’s loss with stochastic collateral,” Quantitative Finance, 1–30, 2025.

Géraldine Bouveret, Jean-François Chassagneux, Smail Ibbou, Antoine Jacquier, Lionel Sopgoui. “Propagation of a carbon price in a credit portfolio through macroeconomic factors,” SIAM Journal on Financial Mathematics, 16(2):545–605, 2025.

2021

Lionel Sopgoui. “Les essais de Paukémil, l’intrus universel,” Books on demand, 2021.

🌍 Talks

Upcoming

Quantitative Methods in Finance 2025, 16-19th November, “Impact of the Carbon Price on Credit Portfolio’s Loss with Stochastic Collateral,” Sydney, Australia.

2025

Séminaire “Actuariat & Finance” - IRA-ISFA-ENSAE-CNAM-ISUP, 21th November, “A stochastic SIRS model for cyber contagion: application to firms growth and insurance portfolio,” Le Mans, France.

SIAM Conference on Financial Mathematics and Engineering (FM25), 15-18th July, “Modeling the Impact of Climate Transition on Real Estate Prices,” Miami, Florida, U.S.

EconophysiX seminar, 8th April, “A top down and a bottom-up approaches for financial fragility under Climate Change,” Capital Fund Management, Paris, France.

UCLA - Financial and Actuarial Mathematics Seminar, 20th February, “Pricing and hedging of climate transition risk in Credit Portfolio,” UCLA, Online.

London-Oxford-Warwick Financial Mathematics Workshop, 9-10th January, “Modeling the impact of climate transition on real estate prices,” University of Oxford, Oxford, England.

2024

9th Green Finance Research Advances, 9-10th December, “Impact of Climate transition on Credit portfolio’s loss with stochastic collateral,” Auditorium - Banque de France, Paris, France.

Groupe de Travail - Risques Climatiques, 17th October, “Modeling the impact of climate transition on real estate prices,” CACIB, Montrouge, France.

12th Bachelier World Congress of the Bachelier Finance Society, 8-12th July, “Propagation of carbon taxes in credit portfolio through macroeconomic factors,” FGV EMAp, Rio de Janeiro, Brazil.

XXV Workshop on QUANTITATIVE FINANCE, April 11-13 2024, “Impact of Climate transition on Credit portfolio’s loss with stochastic collateral,” Università di Bologna, Bologna, Italy.

Séminaire Bachelier, 9th February, “Impact of climate transition on Loss Given Default with stochastic collaterals,” Institut Henri Poincaré, Paris, France.

2023

8th Green Finance Research Advances, 13-14th December, “Propagation of carbon taxes in credit portfolio through macroeconomic factors,” Auditorium - Banque de France, Paris, France.

European Summer School in Financial Mathematics, 04-08th September, “Propagation of carbon taxes in credit portfolio through macroeconomic factors,” Delft University of Technology, Delft, The Netherlands.

London/Oxford/Warwick Financial Mathematics Workshop, 12-13th July, “Diffusion of carbon price in credit portfolio through macroeconomic factors,” King’s College London, London, England.

Groupe de travail des thésards du LPSM, 30th May, “Propagation of carbon tax in credit portfolio through macroeconomic factors,” Sorbonne Université, Paris, France.

QUANTITATIVE FINANCE Workshop 2023, 20-22th March, “Diffusion of carbon price in credit portfolio through macroeconomic factors,” Università di Cassino, Gaeta, Italy.

2022

London-Paris Bachelier Workshop (6th edition), 15-16th September, “Diffusion of carbon price in a credit portfolio through macroeconomic factors,” Institut Henri Poincaré, Paris, France.

💡 Teaching

I worked as a teaching assistant on the following courses:

- Financial mathematics at ENSAE Paris: the first year of a master’s degree students in Introduction to financial derivatives, Valuation in the financial markets, Pricing by tree, Stochastic calculus, Black & Scholes model.

🎓 Education

PhD in Mathematical Finance

Université Paris Cité/Imperial College London

Advisors: Jean-François Chassagneux, Antoine (Jack) Jacquier and Smail Ibbou

Paris, France

September 2021 - November 2024

- Thesis: Pricing and hedging of transition risk in Credit Portfolio

- My work revolves around Applications of Probability and Stochastic Control in Economic Modelling, Climate transition risk and Credit Risk.

M.S. in Financial Mathematics: Statistics and Finance

Ecole Polytechnique - ENSAE Paris

Palaiseau, France

September 2019 - December 2020

- Thesis: Machine Learning for Finance

- Courses: Interest rates models, Algorithmic trading, Derivatives, Advanced Machine Learning, Portfolio modelling, financial econometrics, GARCH and stochastic volatility models, Duration Models, etc.

Engineering Degree in Statistical Modelling and Applications

Telecom SudParis

Evry, France

September 2017 - December 2020

- Thesis: Machine Learning for Finance

- Courses: Probability, Statistic and data analysis, Optimization, Data mining, Stochastic process, Economic Modelling, Microwave, Data networks, Web architectures and applications, Humanities, etc.

BSc in Mathematics and Computer Science

National Advanced School of Engineering

Yaounde, Cameroon

September 2012 - July 2015

- Courses: Probability, Statistics, Electromagnetism, Mechanics, General, linear and multilinear algebra, Real and vector analysis, Numerical analysis, Electro-kinetics, Geometric and wave optics, Statics, Database, Object-oriented programming, etc.

🏆 Projects

Trading Algorithms on Stocks (via IBKR API) and on Cryptos (via Binance API) The aim here is to build statistical arbitrage strategies on different markets, implement them in Python, and apply them to Interactives Brokers.

Deep and Reinforcement Learning for Black-Scholes Options Pricing and Hedging Here, we have used the new Deep and Reinforcement learning tools to calculate the value of vanilla options and the associated hedging strategies.

Correlation between economic conditions and stock market profits (Python) Using simple statistical analyses (linear regression), we have tried to verify that stock markets (S&P500) are correlated with economic indicators (inflation, unemployment rate, interest rate).

Statistical inference analysis and the ML models on DAX and EURO STOXX Futures The aim here was to build trading strategies using machine learning to build trading strategies.

💾 Resume

🎳 Hobbies

Regular runner and tennis player.

Writer and philosopher.

Fan of 🏀basketball (Golden State Warriors), 🎾tennis (Novak Djokovic) and 🚴♀️cycling.

Traveler 🧳.